What is Gift Aid?

Gift Aid is a scheme that allows charities to claim back basic rate tax already paid on donations by the donor, and is currently worth 25p for every pound donated by UK tax payers.

Example: If a donor gives £10 to charity and is a basic rate tax payer (20%), they will have paid £2.50 in tax on the gross donation (to take £10 home, you will have received £12.50 before tax). Charities are able to reclaim this £2.50 back from HMRC.

Higher rate tax payers can benefit from the tax relief too, as they can claim back the difference between the higher rates of tax at 40% and 50% and the basic rate tax at 20% on the total value of the gross donation.

What is Transitional Relief?

Before the 2008 budget, Gift Aid was worth 28p for every pound. However, this was changed to 25p per pound due to a lowering of basic rate tax from 22% to 20% and left charities facing a considerable loss. To make sure that charities had time to adjust to the loss in revenue, the government introduced a temporary scheme called Transitional Relief, which made up for the short-fall, giving charities an extra 3p per pound on all Gift Aid claims. This ran until April 2011.

Transitional Relief can be claimed retrospectively on donations made before 5th April 2011 for up to 2 years.

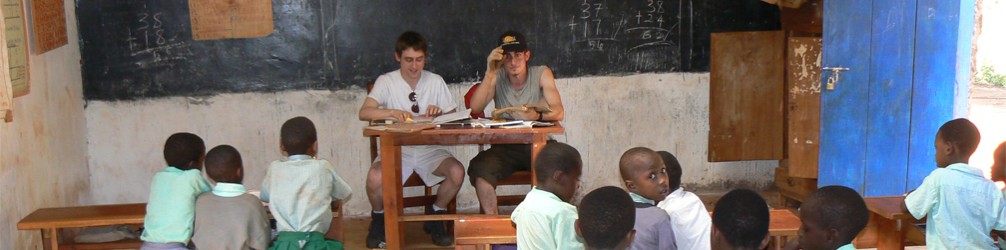

If you’ve participated in one of our trips and paid fund-raised monies in by any means other than our recommended online giving service (BT MyDonate) then your fundraised monies may be eligible for Gift Aid. If this is the case then please fill in our secure Gift Aid Form and a member of our team will get in touch to discuss this with you.

Information provided by:

http://www.hmrc.gov.uk/individuals/giving/gift-aid.htm

http://www.tax-effective-giving.org.uk/?pageid=What_is_Gift_Aid.xml